Who Is Still Buying US Scrap Paper?

By Jock O’Connell

Despite moves by foreign governments to clean up the volume of scrap paper they buy from us, Waste and Scrap Paper (HS 4707) was historically the leading containerized export commodity from U.S. ports, until last year when polymers of ethylene took over that distinction. See Exhibit 10.

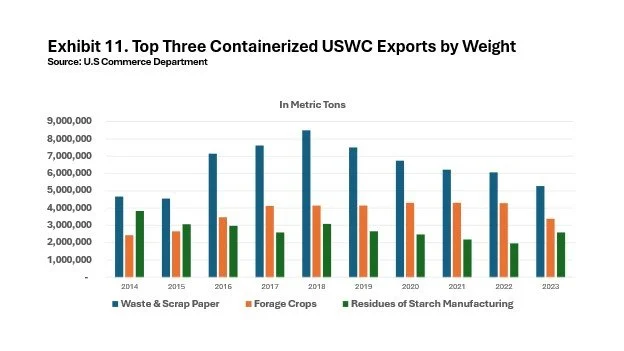

The situation is somewhat different on the West Coast, where Waste & Scrap Paper volumes have decreased, but remain the top containerized export by weight and Forage Crops (Hay, Clover) replace Polymers as the second leading containerized export. See Exhibit 11.

How has the overseas market changed in the past decade? The biggest change was China’s effective departure from the U.S. Waste and Scrap Paper export trade, as depicted in Exhibit 12.

As this exhibit shows, U.S. West Coast ports bore the blunt of the decline in export tonnage.

Exhibit 13 displays how the overseas destinations of Waste and Scrap Paper shipments through U.S. West Coast ports have developed over the past decade. As China left the trade and as the overall volume of exports plunged 45.4% from 9,723,919 metric tons in 2014 to 6,309,821 metric tons last year, Thailand, Malaysia, and Vietnam have picked up their imports of this commodity. However, the trade has declined a further 33.7% in the first eight months of this year from the same period in 2023.