West Coast Trade Context for July 2024

By Jock O’Connell

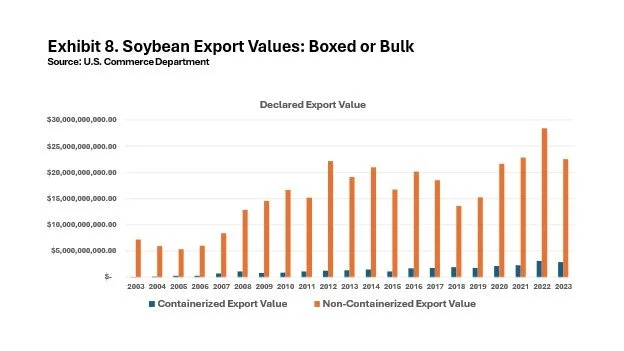

Does the small percentage of U.S. soybeans shipped oversea in containers - 10.5% last year - constitute a specialty crop that commands a much higher value than do soybeans shipped overseas in bulk? While there are certain categories of soybeans that do command premium prices and have traditionally been shipped in containers, it does appear that soybeans travelling in containers have only a minor overall premium, especially when compared to the premiums that containerized soybeans once enjoyed.

As Exhibit 6 reveals, what was once a 50% premium on the value of containerized soybean exports has sharply eroded over the years.

Wine bottle manufacturers in China, Chile and Mexico are looking at new U.S. tariffs that may range as high as 218.15% as the result of Countervailing Duty and Antidumping investigations by the U.S. Commerce Department. To the extent higher duties distort trade, the logistical impact will be felt at border crossings with Mexico and at U.S. West Coast ports, which handled 71.1% of glass wine bottle shipments to the U.S. from China during the first half of this year. Exhibit 6 reveals the breakdown over the past ten years. As Mexico has emerged as an ever-larger supplier of glass wine bottles, the role of Chinese manufacturers has not only fallen off, but the trade has also been rechanneled south, with the San Pedro Bay ports emerging as the preferred point-of-entry. That shift stands out because most of America’s wine is produced in Northern California, a region more immediately in the hinterland of the Port of Oakland.

Regardless of whether measured in dollars or tons, containerized soybean shipments continue to account for a fairly small share of the nation’s overall soybean export trade. More importantly, the premium once attached to containerized soybean shipments has evaporated over time.

Among the niche ports along the U.S. West Coast is the Port of Everett. The Washington State port specializes in handling conventional and over-dimensional cargoes for the construction, manufacturing, aerospace, energy, military, agriculture, energy, and forest products industries. The Port lays claim to supporting 40,000 jobs, while actively contributing $433 million in state and local taxes. Most conspicuously, the Port handles 100 percent of the oceanborne traffic in oversized aerospace parts for Boeing’s nearby aircraft assembly plants.

On September 6th, the Port of Oakland issued a Request for Qualifications (RFQ) seeking a developer for its 50-acre Howard Terminal property. The former marine terminal is located along the Oakland waterfront and features a deep-water berth. The property is adjacent to industrial operations to the west and Jack London Square to the east. The Port will consider a wide range of submissions, including maritime, light industrial, commercial, recreational, and/or water-oriented uses.

Apparently, not included in this list of qualified proposals is a sports complex surrounded by high-end residential units that would be wholly incompatible with the operations of a modern seaport.

PMSA has long had more than a passing interest in developing Howard Terminal in ways consistent with the clamorous activities of a busy seaport, especially one that aspires to 24/7 operations. We anxiously await a chance to review the proposals the Port’s RFQ yields.

To view the Port’s RFQ: https://www.portofoakland.com/rfq-charles-p-howard-property/